Exploring Opportunities: Technology Business for Sale

Introduction

In today’s dynamic landscape, technology businesses for sale present an incredible opportunity for investors and entrepreneurs alike. The rapid advancement in technology has paved the way for various sectors, including software development, IT services, and e-commerce, to flourish. As a result, there is a growing market for established businesses seeking new ownership, whether for growth, innovation, or simply changing hands for strategic reasons.

The Growing Demand for Technology Businesses

The demand for technology businesses is soaring due to several factors:

- Continual Technological Advancement: With emerging technologies such as artificial intelligence, machine learning, and cloud computing, businesses that harness these innovations are in high demand.

- Shift in Consumer Behavior: The shift towards online services has made tech businesses a necessary staple, making them highly appealing for acquisition.

- Globalization: As companies expand their global reach, technology businesses that can operate internationally are becoming increasingly attractive assets.

Benefits of Investing in Technology Businesses

Investing in a technology business for sale can yield numerous advantages:

- Profitable Returns: The potential for high returns on investment is significant, particularly in sectors like SaaS (Software as a Service) and cybersecurity.

- Scalability: Many tech businesses are designed to scale, allowing for exponential growth with relatively lower incremental costs.

- Innovation Opportunities: Owning a tech business opens the door to innovative ideas, products, and solutions that can disrupt markets.

- Established Customer Base: Acquiring a technology business often comes with a loyal customer base, which can dramatically shorten the time to profitability.

Key Considerations Before Purchasing a Technology Business

Before diving into the world of technology business for sale, potential buyers should consider several crucial factors:

1. Evaluate the Financial Health

Analyzing a company's financial statements to ensure profitability and sustainability is vital. Look for:

- Revenue trends over the past few years

- Profit margins

- Cash flow statements

- Debt and liabilities

2. Understand Market Position

Assess the company’s standing in the market. Determine:

- Market share

- Competitive advantages

- Brand recognition and reputation

3. Assess Growth Potential

Consider the scalability of the business. Investigate potential for:

- New products or services

- Expansion into new markets

- Partnerships and collaborations with other organizations

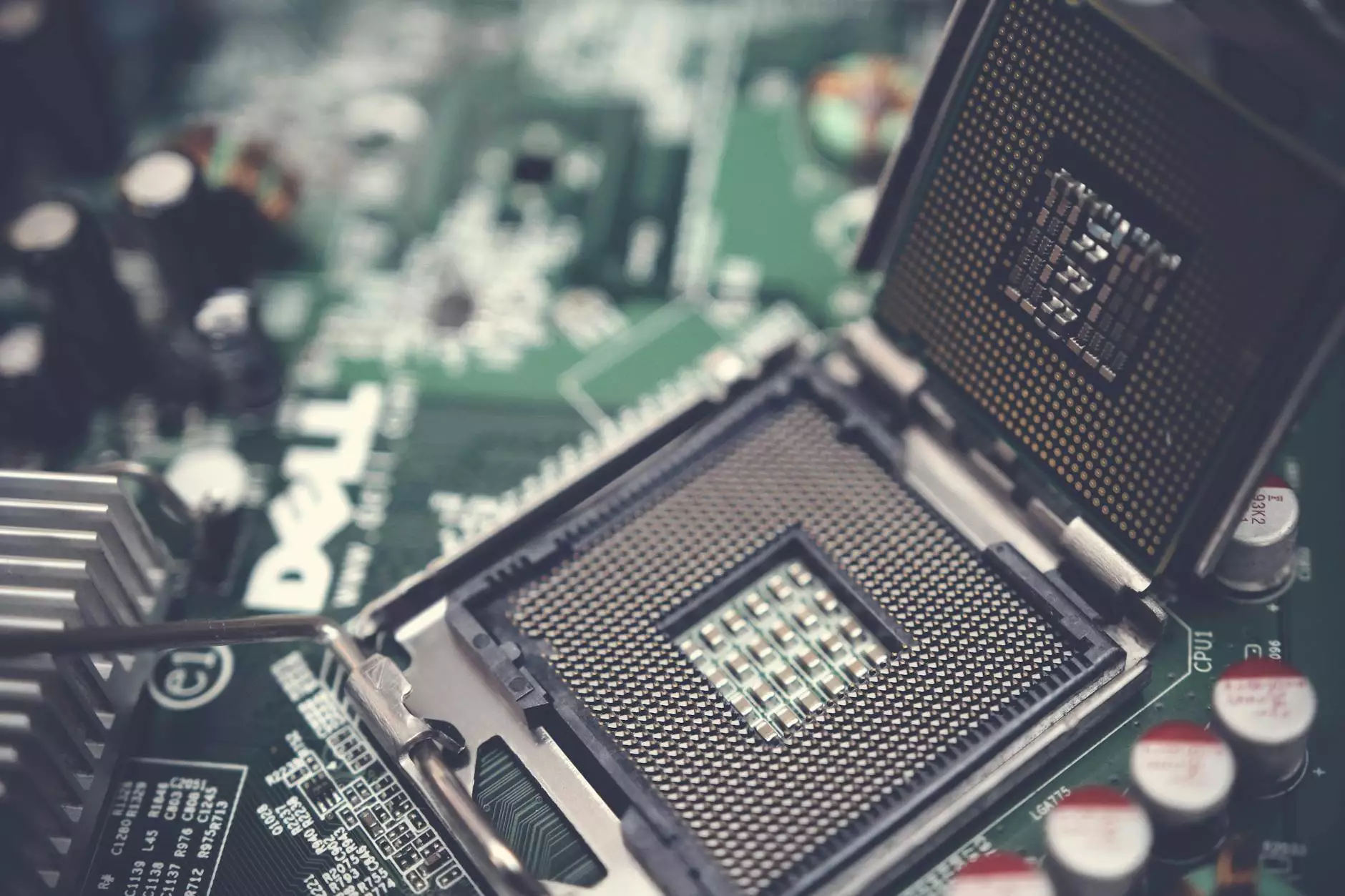

4. Evaluate the Technology Stack

Understanding the technology the business leverages is crucial. Evaluate:

- Current technology infrastructure

- Intellectual property, including patents and licenses

- Compliance with industry standards and regulations

Steps to Successfully Acquire a Technology Business

The process of acquiring a technology business for sale can be intricate. Here are essential steps to take:

1. Research and Identify Potential Targets

Begin by conducting thorough market research to identify technology businesses that align with your investment goals. Look for:

- Businesses listed on online marketplaces

- Networking within industry events

- Consulting with business brokers specializing in technology

2. Conduct Due Diligence

Once you identify potential businesses, conduct due diligence. This involves inspecting:

- Legal documents

- Employee contracts and organizational structure

- Client contracts and retention rates

3. Secure Financing

Determine how you will finance the acquisition. Options may include:

- Personal savings

- Bank loans

- Investor funding

- Seller financing

4. Negotiate the Sale Terms

Negotiate the terms of the sale, including price, payment structure, and transition periods. Be prepared to:

- Discuss contingencies

- Structured payments based on performance

- Post-acquisition support from sellers

5. Close the Deal

After negotiations are complete, finalize the transaction by signing all necessary contracts and transferring ownership. Focus on:

- Ensuring compliance with regulatory requirements

- Transitioning operations smoothly

- Communicating with employees and customers

Post-Acquisition: Transitioning and Growth Strategies

Once the purchase is complete, focus on a successful transition and growth. Consider these strategies:

1. Foster Company Culture

Establish a company culture that aligns with your vision while respecting existing values. This can help retain talent and maintain morale.

2. Enhance Technology and Processes

Invest in upgrading technology and streamlining processes to enhance efficiency and productivity. Consider:

- Implementing agile project management methodologies

- Adopting cloud-based solutions

- Integrating advanced analytics for data-driven decision-making

3. Market Expansion

Explore new markets for the business's products or services. Evaluate:

- Geographical expansion opportunities

- Emerging needs in existing markets

- Cross-industry partnerships to increase reach

4. Continuous Innovation

Encourage a culture of innovation within the business. Invest in R&D to keep up with industry trends and develop new solutions.

Conclusion

Investing in a technology business for sale can be a lucrative venture if approached strategically. By understanding the market, the benefits of acquiring a tech business, and the intricate steps involved in the process, you can position yourself for success. As the demand for technology continues to spiral upwards, tapping into this sector can yield both financial rewards and the satisfaction of contributing to the technological advancement of industries and society as a whole.

Contact Us for Business Consulting

If you're considering purchasing a technology business, OpenFair is here to assist you. Our expertise in business consulting can help navigate the complexities of acquisition and ensure successful outcomes. Contact us today to learn more!